Business setup

in Bosnian and Herzegovina

After finishing all the paperwork for establishing a company, you need to be familiar with a few more things related to business setup in Bosnia and Herzegovina.

In this article, we will say a few words about fiscal cash register, labor rights, and tax -VAT system.

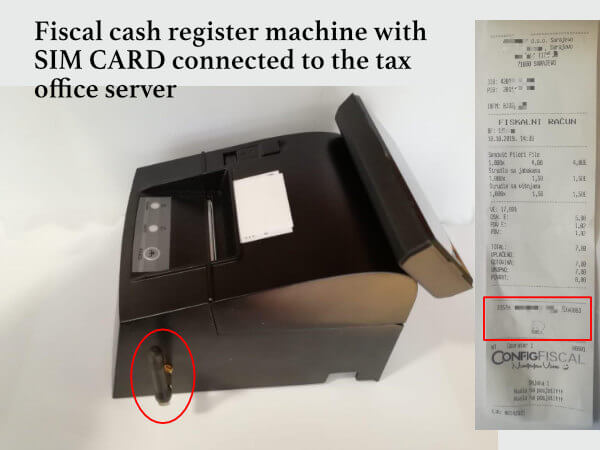

1-FISCAL CASH REGISTER:

All companies in Bosnia and Herzegovina must have a device called a fiscal cash register.

The device is connected with the server of the tax office and records all traffic of the company.

For all services the company charges, the fiscal bill must be printed. The price of the fiscal cash register depends on the type, and it is between 500 KM -1000 KM.

2-LABOR RIGHTS:

The Labor Law provides the working conditions, wages, working hours, and other rulings.

- The company must have at least one employee

- The working hours shall not exceed 40 hours per week. When the position and job’s duties require extended hours, the maximum working hours can be to 60 hours per week. A full-time employee shall be entitled to a break during daily work for the duration of at least 30 minutes. An employee shall be entitled to a weekly break in the period of at least 24 hours without interruption. If it is necessary that the employee works on the day of his weekly break. Then the employee shall be provided one day in the period determined based on the agreement between the employer and the employee.

- For each calendar year, an employee shall be entitled to paid annual leave in the duration of at least 18 working days. An underage employee shall be entitled to annual leave in a period of at least 24 working days. An employee working in jobs in which, irrespective of the labor protection measures, it is not possible to protect him/her from harmful effects, shall be entitled to annual leave in the duration of at least 30 working days.

- A worker who is employed for the first time or who has a break between two employment relationships longer than 15 days acquires the right to annual leave after six months of uninterrupted work.

If the employee has not acquired the right to annual leave within the meaning of the above paragraph of this Article, the employee is entitled to use at least one day of annual leave for each completed month of work. - For each employee, the company must pay the salary, health insurance, and pension insurance.

According to Article 14 of the Law on United System of Registration, Control and Collection of Contributions (O cial Gazette of FB&H, no. 42/09 and 109/12, as amended by “O cial Gazette of FB&H”, no. 30/16). - The company is obliged to register each employee at the Tax Administration one day before the commencement of work at the latest. The following document should be submitted:

- Court resolution on registration in the registry,

- Certificate of the Identi cation and Statistic number,

- Form JS 3100.

3-TAX VAT SYSTEM

The basic taxation categories are:

- Value Added Tax

- Corporate income tax

- Personal income tax

- Property tax

- Social security contributions paid by employers and employees

- Excises, a particular type of sales tax paid on some commodities like oil products, tobacco products, soft drinks, alcohol drinks, beer, wine, and coffee.

CATEGORIES of TAX RATE

- Value Added Tax 17% (FB&H,RS, BD)

- Corporate Income Tax 10% (FB&H,RS, BD)

- Personal Income Tax 10% (FB&H,RS, BD)

Value-added tax (VAT)

The individual VAT rate is 17%. The Indirect Taxation Authority is in charge of collecting value-added tax and coordinating fiscal policy issues in general. This body is also responsible for collecting customs and excises on the entire territory of Bosnia and Herzegovina.

Value-added tax is a comprehensive tax on consumption, assessed based on the value-added to goods and services. The Value-added tax is a general tax applied to all commercial activities, including the manufacturing and distribution of products and providing services. It is a consumption tax because it is not paid by the company, but by the end-user — value-added tax assessed as a percentage of the cost of goods or services. The tax amount is visible in all stages, from manufacturing to the distribution chain. When paying the tax liability, the taxpayer will reduce the value-added tax by the tax amount he/she has already paid to other taxpayers at purchase. This process ensures the neutrality of taxation, regardless of the number of transactions involved.

The corporate income tax rate in B&H

- Federation B&H – 10%

- Republic of Srpska – 10%

- Brcko District – 10%

In Bosnia and Herzegovina, there are no taxes on profits transferred from abroad.

Profits transferred from abroad are not taxed if they were previously subject to taxation abroad.

Corporate taxable basis

By applicable laws, calculating the profits is by deducting (real) expenses from revenues. The tax base includes profit gained through revenues and capital gains, according to the accounting regulations. The expenditures must conform to the accounting standards.

Personal income tax rates

In the Federation of Bosnia and Herzegovina – Personal income tax is 10 % on net income (in accordance with gross model).

In the Republic of Srpska – Personal income tax is 10% on net income (in accordance with gross model).

Foreigners and taxes in Bosnia and Herzegovina

All foreigners with permanent residence in the Federation of Bosnia and Herzegovina and the Republic of Srpska pay personal income tax on revenues earned during a calendar year in Bosnia and Herzegovina territory. Equally, all foreigners who do not reside permanently in Bosnia and Herzegovina and earn income in the Federation of Bosnia and Herzegovina and Republic Srpska are conceders as taxpayers.

In Brcko District, foreigners are treated as taxpayers if they stay in the District territory during an uninterrupted period of 183 days at least.

For more information on taxes click here: Bosnia and Herzegovina Tax system.pdf

Read more Introduction of VAT in Bosnia and Herzegovina

It is important to have a good accountant, a good lawyer(s), and a good advisor(s) to consult with for business setup in Bosnia and Herzegovina or any country to grow your business well.

Learn More about:

working permit in Bosnia and Herzegovina

Resident visa in Bosnian and Herzegovina